Buy-to-Let: The Mortgage Clinic's advice on becoming a landlord in the Maldon District

By The Editor 12th Sep 2023

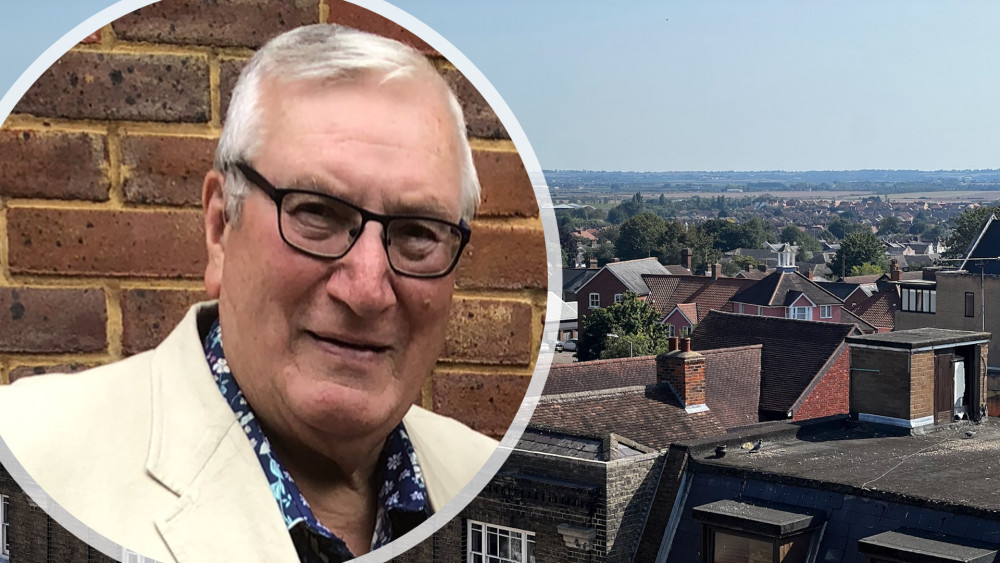

Bryan Ledger, from local broker The Mortgage Clinic, provides advice to help prospective landlords in the Maldon District navigate Buy-to-Let mortgages.

Buy-to-Let Mortgages were introduced in 1996. They provided an outlet for those who favoured property investment, having generally had good experience with their residential homes.

Many saw this type of investment as an alternative to the poor return on the stock market or pension funds.

There were two primary objectives, either investment for capital appreciation, or income from the rental value. Both elements have combined over the years to create a significant market.

Governments of either creed or colour have reduced investment in social housing. The private rental sector has bridged the gap, providing homes for those who cannot afford to purchase, and those just prior to joining the property ladder.

Today's market is now very complex, not in the least the government's tax treatment of Buy-to-Lets. Company Buy-to-Lets enjoy a more friendly tax status than those held by individuals, causing a significant growth in recent years. The tax relief on interest payments is more limited for individuals if they are on a higher rate tax band. Company Buy-to-Lets enjoy the same regime as any other company, being able to offset all the interest costs against profit.

Forming a company may sound scary, but it is a simple, low-cost exercise. The company must be a new Special Purpose Vehicle (SPV), with the Companies House industry codes specifically designed for property management.

Recent industry figures suggest that 75 per cent of new Buy-to-Lets are becoming company-based. Furthermore, most lenders use a more generous risk assessment for companies, particularly compared to higher-rate taxpayers. The Lender will normally be prepared to lend more on a company Buy-to-Let.

Laws are changing with a proposed Rental Reform Act, but if a property is well managed within the regulations, this can still be an attractive and profitable business.

For tenants, energy performance and insulation values are just as important as they are to any homeowner. There is a shift to newer properties that provide these standards. The rent margin is sometimes a bit less, but lower maintenance and a better potential for capital growth are strong features.

As a Broker, The Mortgage Clinic can lead you through the stages and help you to enter this investment sector. We can give an outline of the structure and tax regime but would stress that you should also seek additional advice from an accountant or tax advisor.

The Mortgage Clinic is just one independent business Maldon Nub News is proud to partner with. Without community-minded supporters like Bryan, Nub News would not be able to produce locally relevant, clickbait-free news for the Maldon District.

Read more

CHECK OUT OUR Jobs Section HERE!

maldon vacancies updated hourly!

Click here to see more: maldon jobs

Share: